Adjustments

Adjustments let you add charges or discounts without editing line items. They support percentage or fixed amounts and respect tax classes. Access requires order/quote manage plus sales.settings.manage to curate kinds and tax rates.

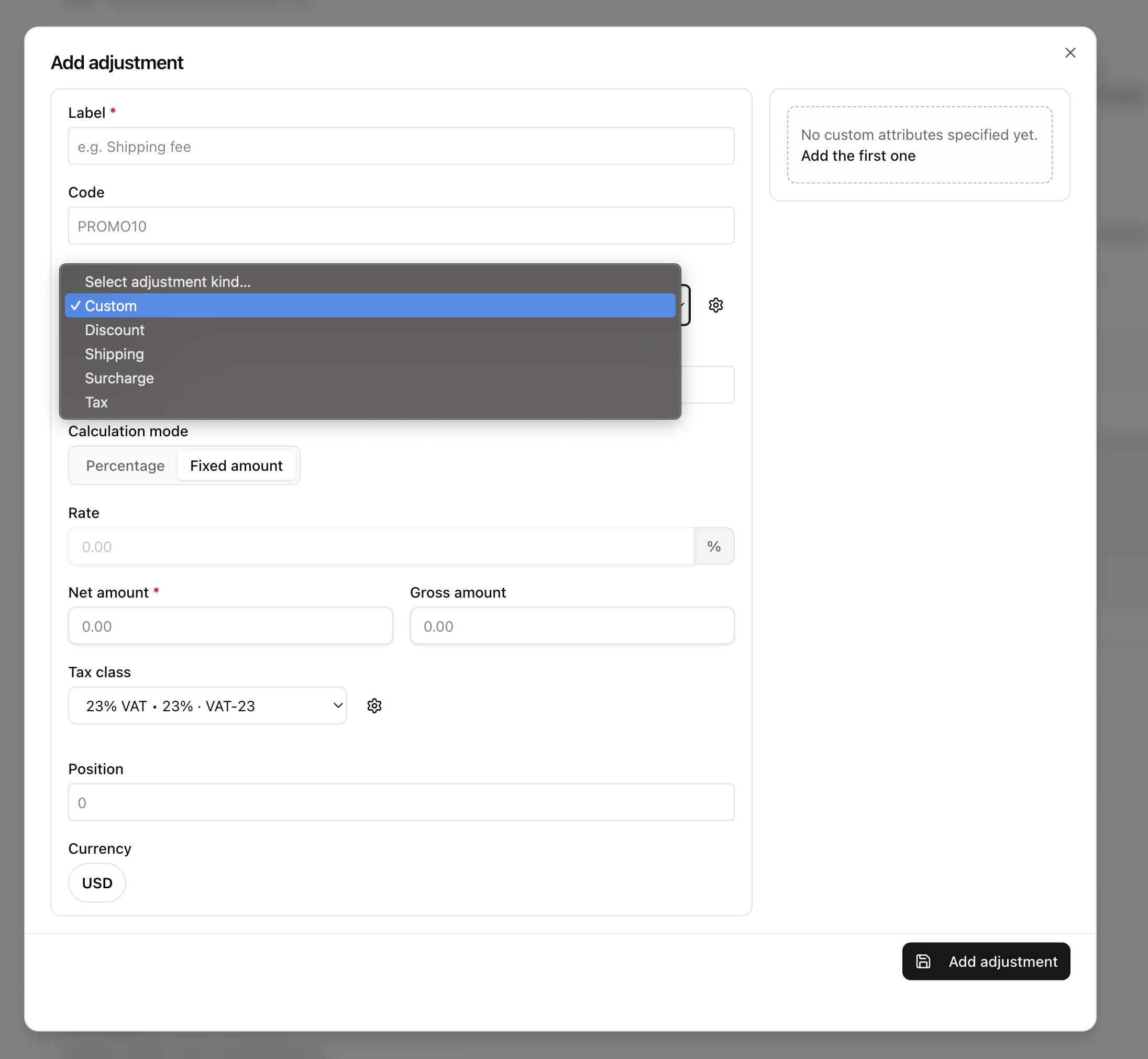

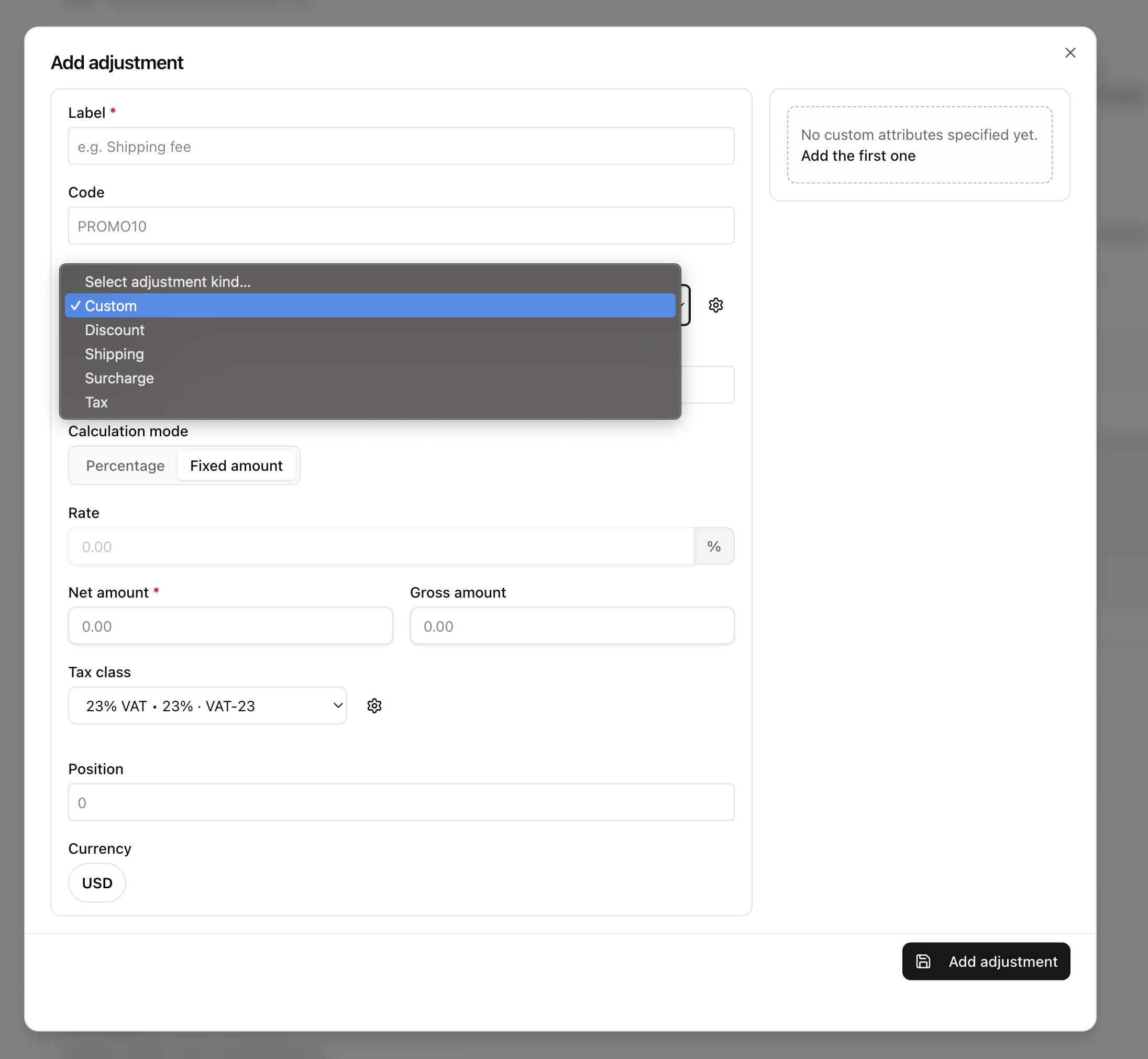

Add an adjustment

- Open Adjustments on the order/quote and click Add adjustment.

- Set label and optional code for reporting.

- Choose adjustment kind (Shipping, Discount, Surcharge, Tax, Custom).

- Pick calculation mode: Percentage or Fixed amount.

- Enter rate or net/gross amount; select a tax class if applicable.

- Set position to control ordering in totals (optional).

- Save with

Cmd/Ctrl + Enter;Escapecancels.

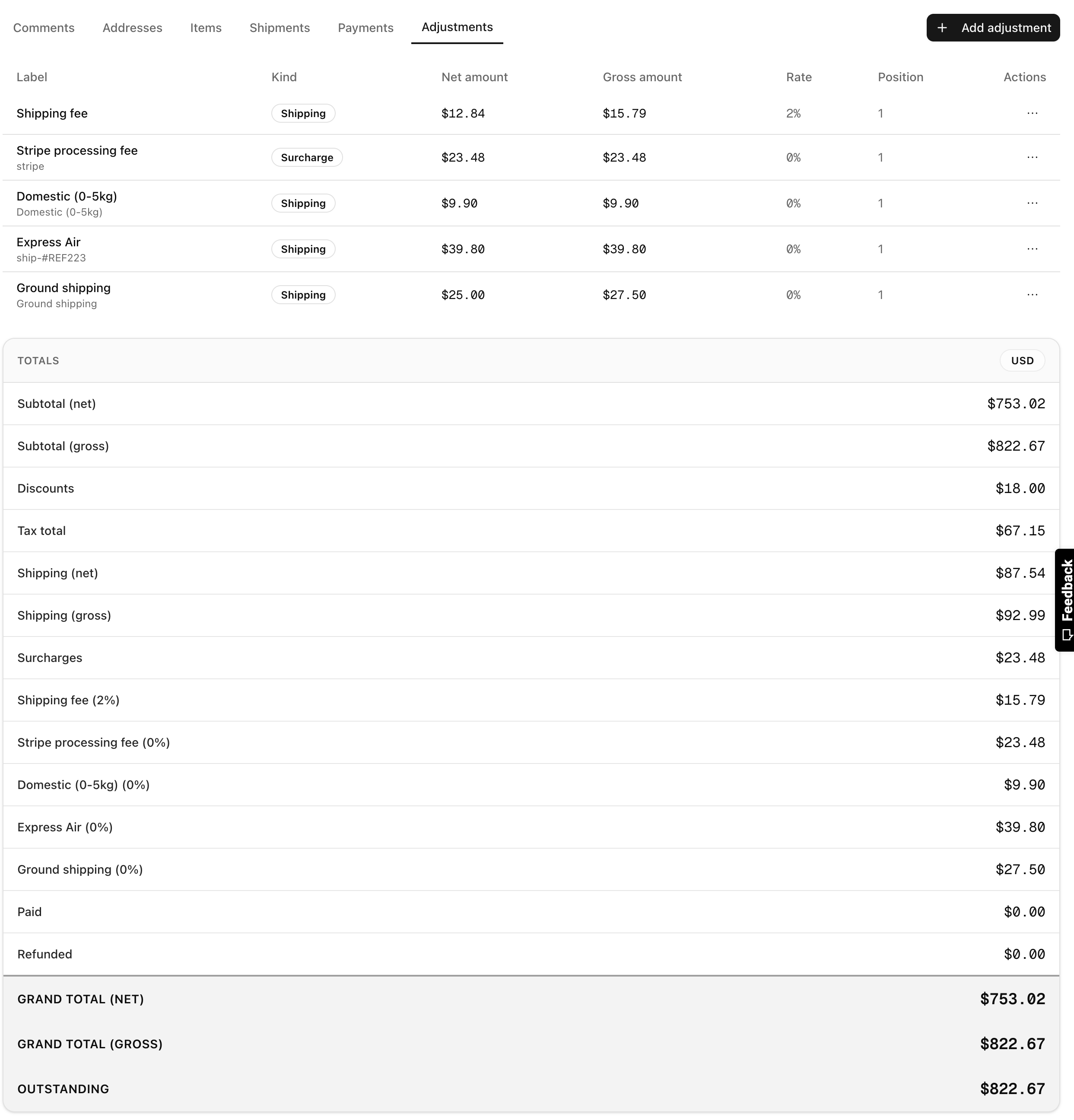

How adjustments roll into totals

- Each adjustment contributes to subtotals and grand totals based on kind and tax class.

- Shipping and surcharge entries increase totals; discounts reduce them; tax adjustments apply the selected rate or amounts.

- Order detail shows grouped totals (net, gross, discounts, surcharges, tax) for transparency.

Tips

- Predefine Adjustment kinds in Sales settings so operators pick from curated options.

- Use percentage for promos tied to the subtotal; use fixed amount for fees like “Stripe processing”.

- Keep tax classes aligned with your catalog pricing for consistent VAT handling.