Sales settings

Use Sales settings to standardize how orders and quotes behave. Access requires sales.settings.manage.

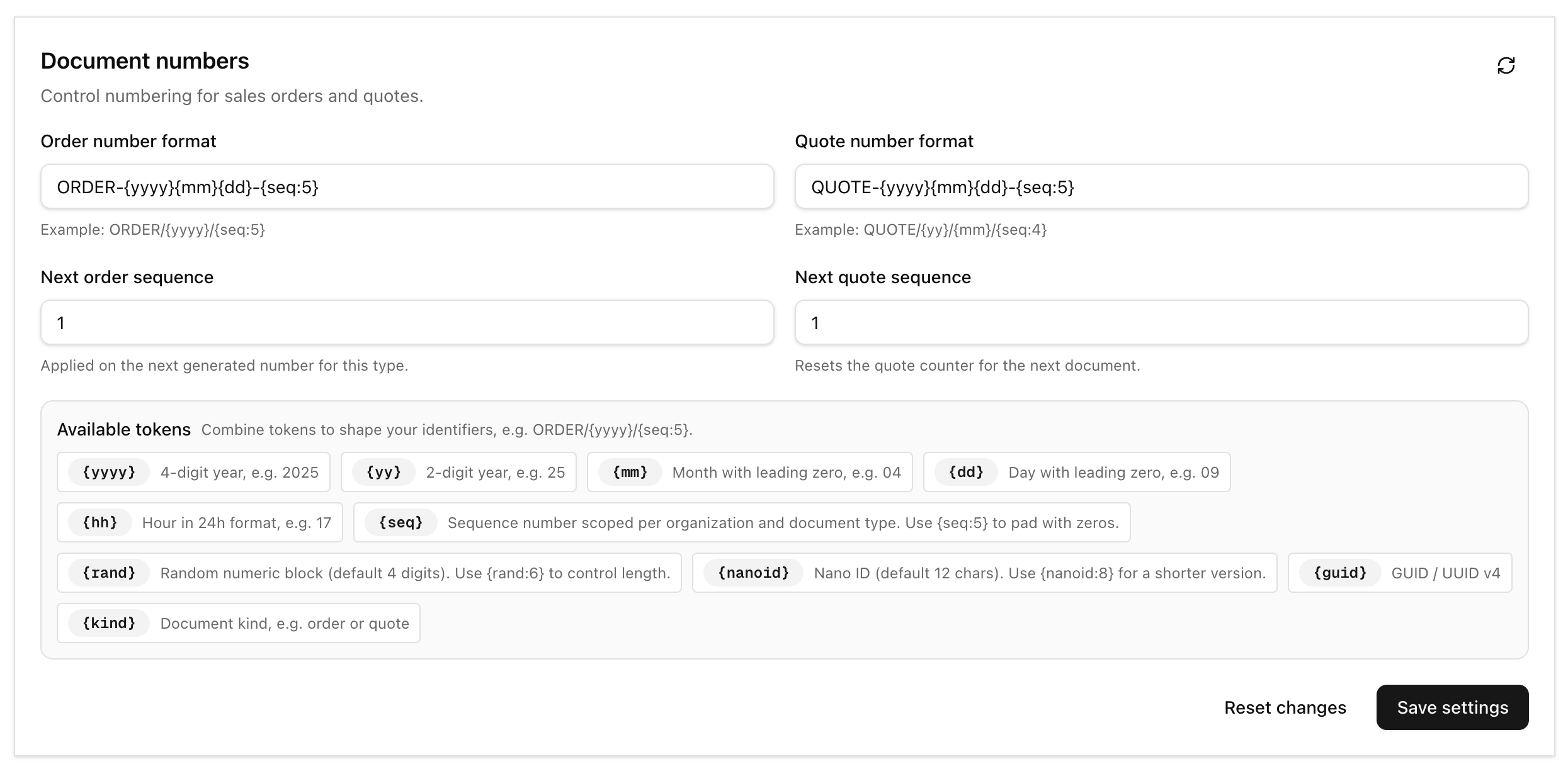

Document numbers

- Configure order and quote number formats with tokens like

{yyyy},{mm},{dd},{seq:5},{kind}. - Control the next sequence per type; sequences are scoped per organization.

- Tokens can combine for readable IDs (e.g.,

ORDER-{yyyy}/{seq:5}).

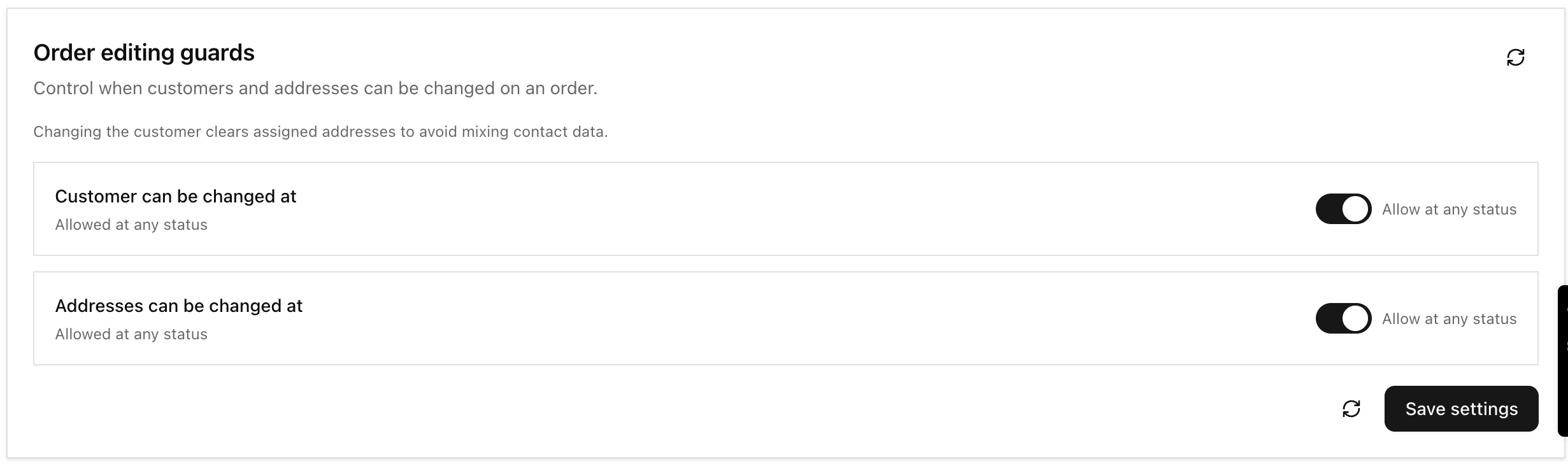

Editing guards

- Decide when customers and addresses can change (any status vs only draft).

- Changing customer clears addresses to prevent data mix-ups.

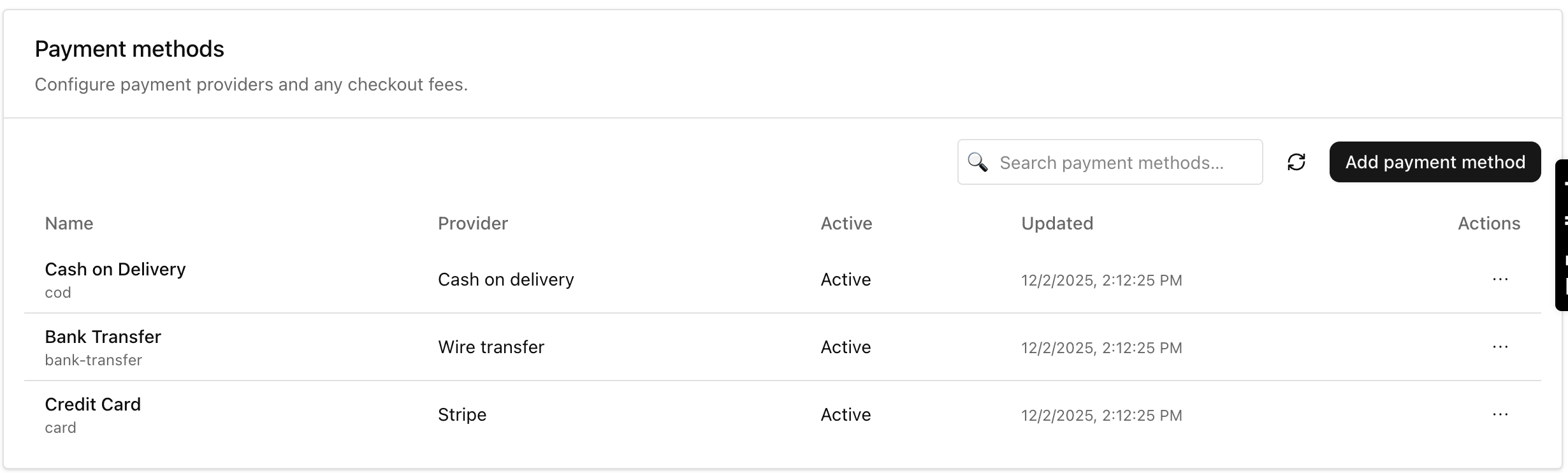

Payment methods and statuses

- Payment methods list providers (e.g., Cash on Delivery, Bank Transfer, Card) and active flag.

- Payment statuses define lifecycle (authorized, captured, pending, received, refunded, failed, canceled).

- Both power the Payments tab and keep reports consistent.

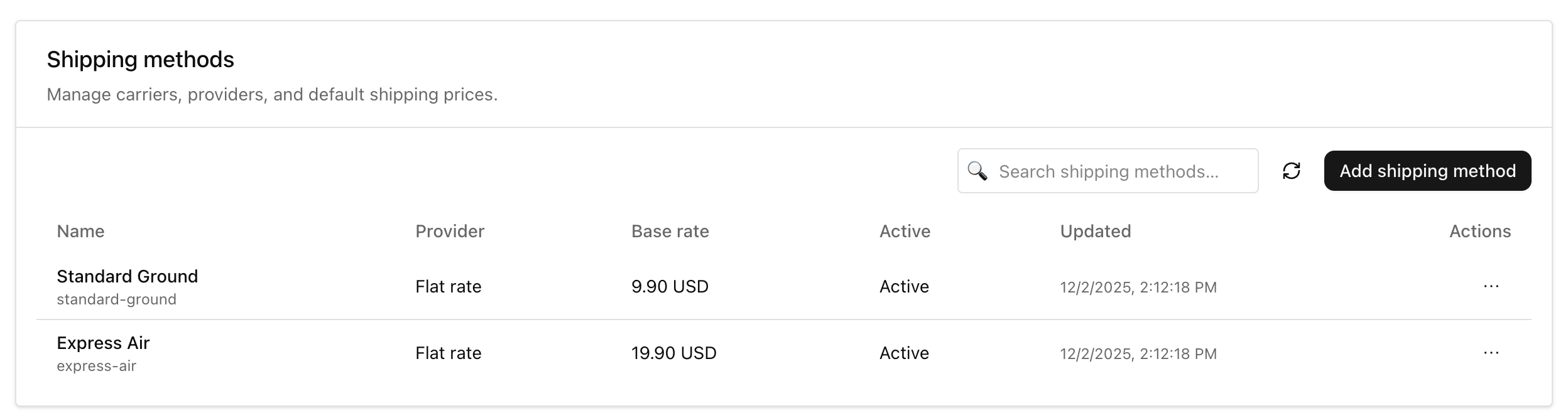

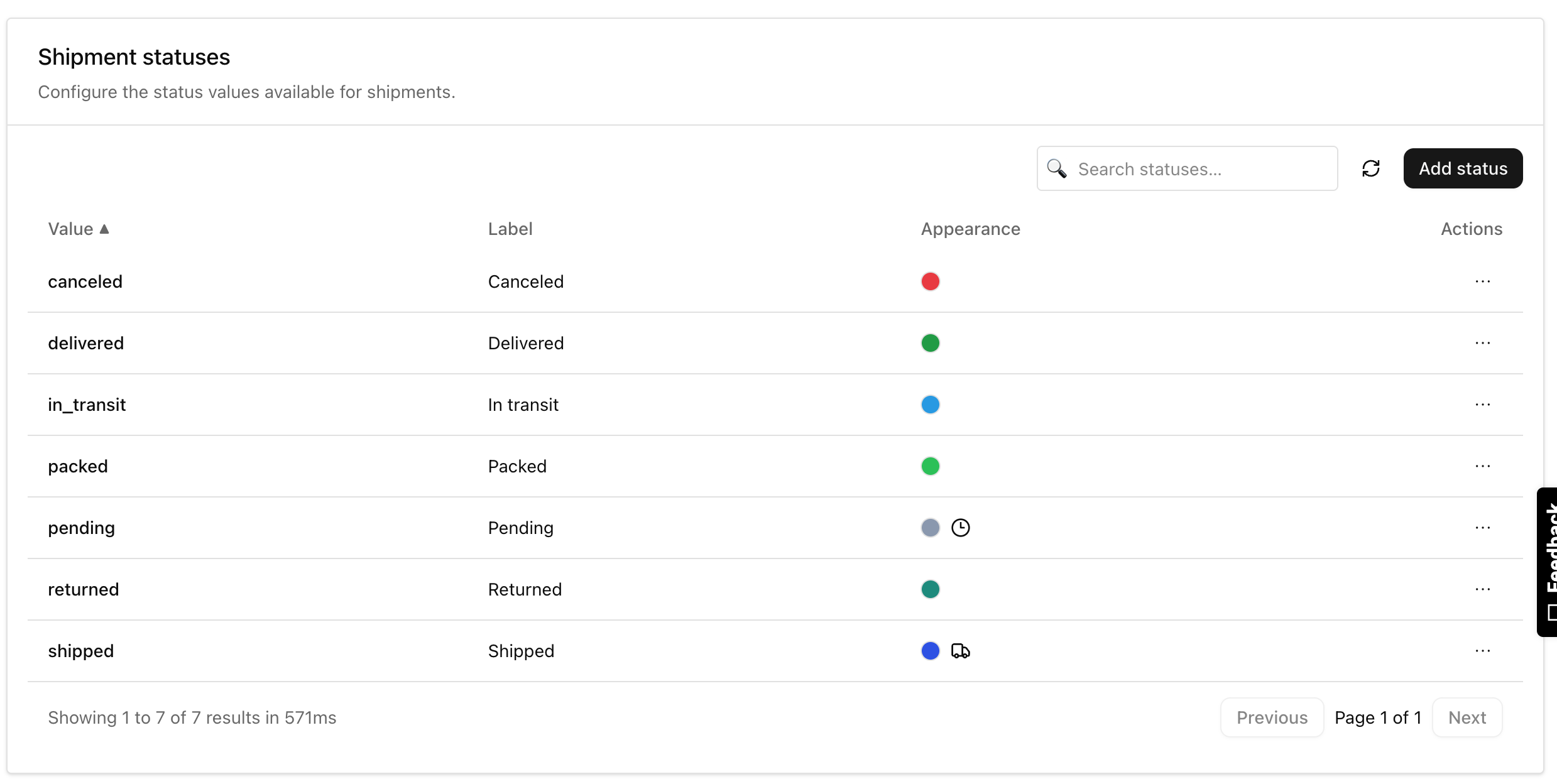

Shipping methods and shipment statuses

- Shipping methods capture provider, base rate, and active flag; used when creating shipments and shipping adjustments.

- Shipment statuses cover fulfillment states (pending, packed, shipped, in_transit, delivered, returned, canceled).

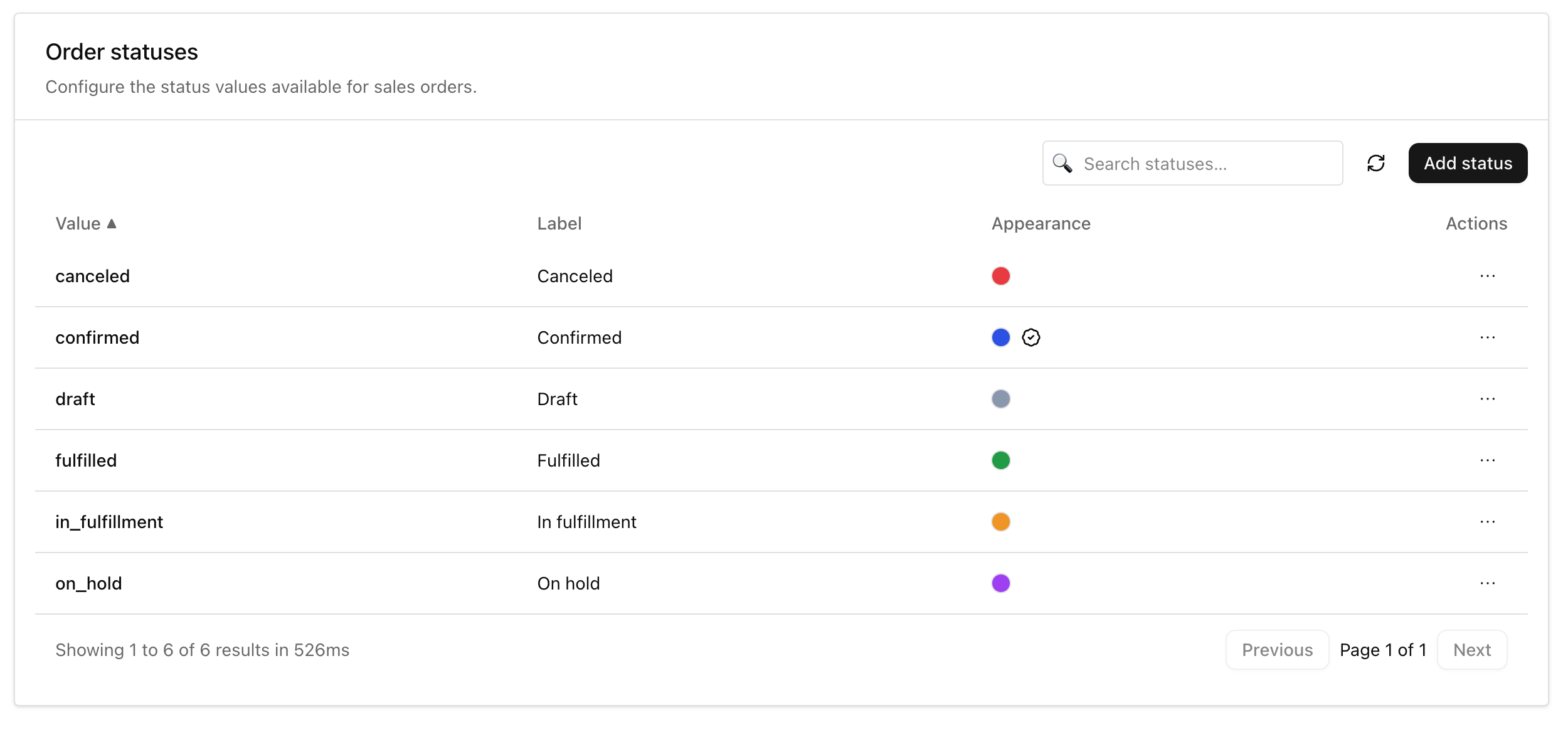

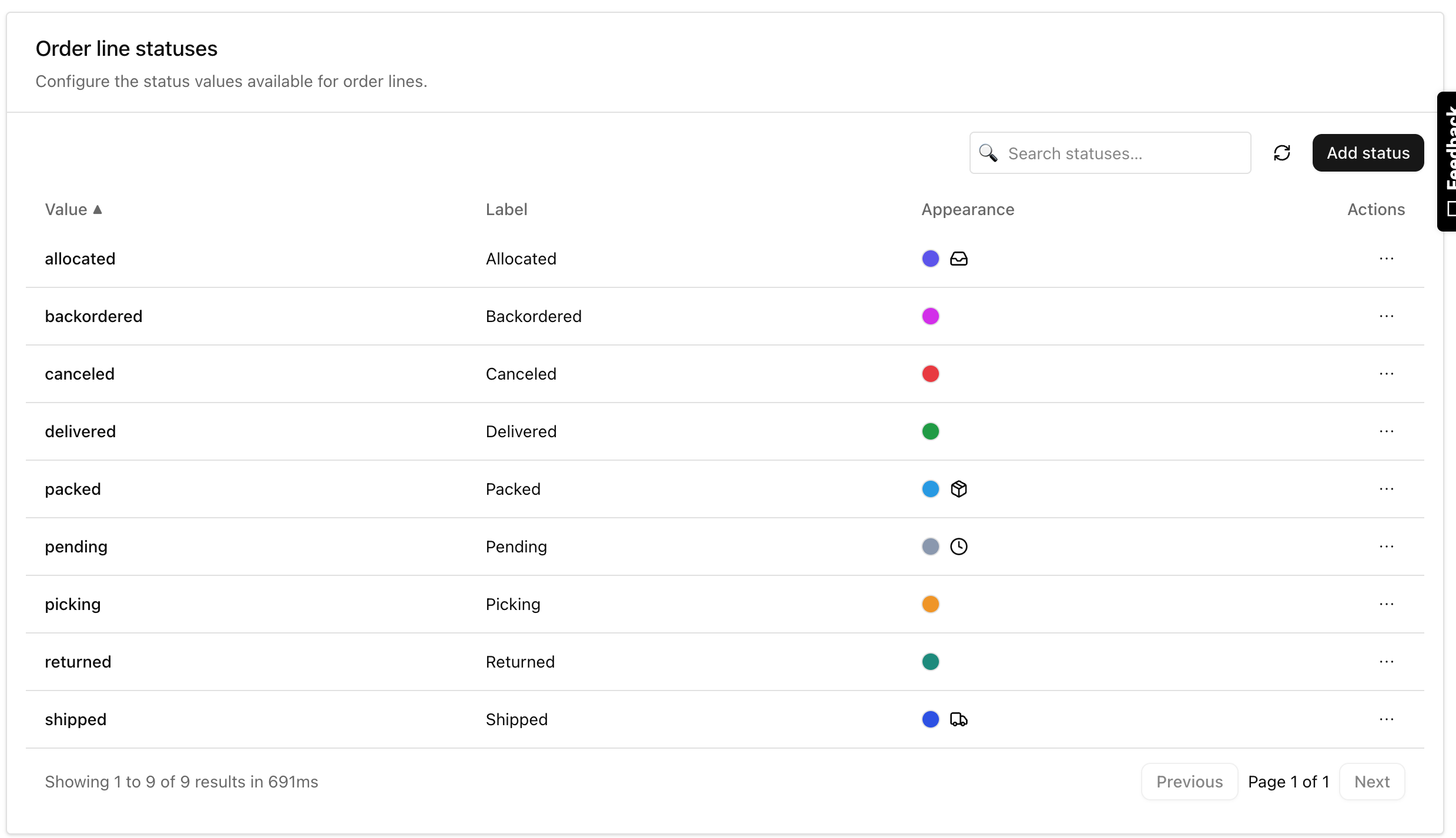

Order statuses and line statuses

- Order statuses control the main document lifecycle (draft, confirmed, in_fulfillment, fulfilled, on_hold, canceled).

- Order line statuses refine per-line fulfillment (pending, picking, packed, shipped, delivered, returned, backordered, allocated).

Adjustment kinds

- Curate reusable kinds (Discount, Shipping, Tax, Surcharge, Custom). Kinds drive the adjustment dialog and reporting.

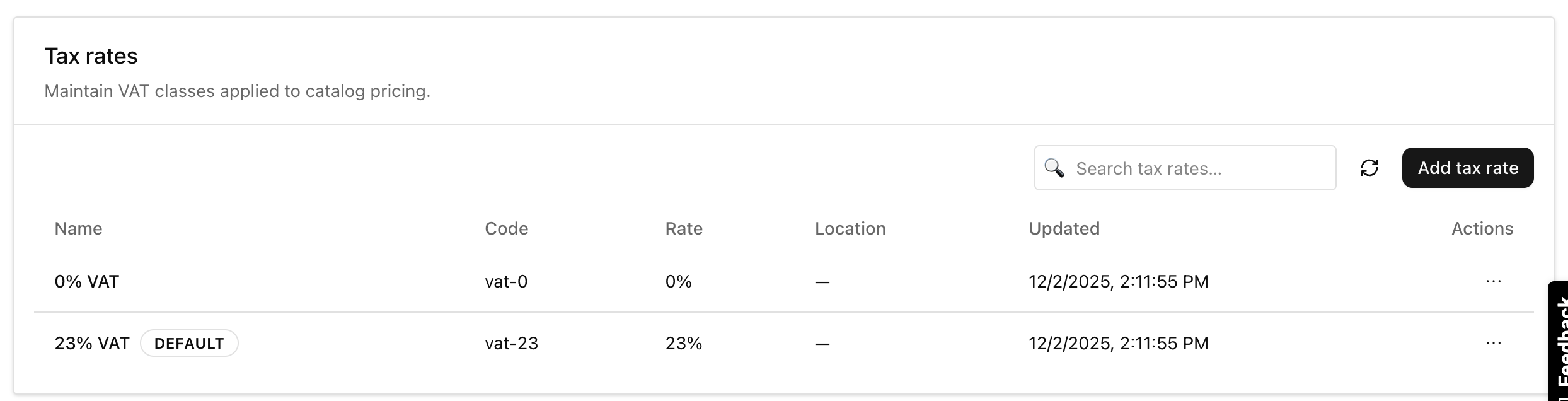

Tax rates

- Maintain VAT/tax classes with code, rate, and default flag. Applied to items and adjustments for consistent totals.

Tips

- Keep naming consistent across methods, statuses, and kinds so operators pick confidently.

- Review guards before go-live to prevent mid-fulfillment edits that could break compliance.

- Align tax classes with catalog pricing and finance reporting.